Table of Contents

- Planning for Personal Tax Laws Changing in 2026 | Mercer Advisors

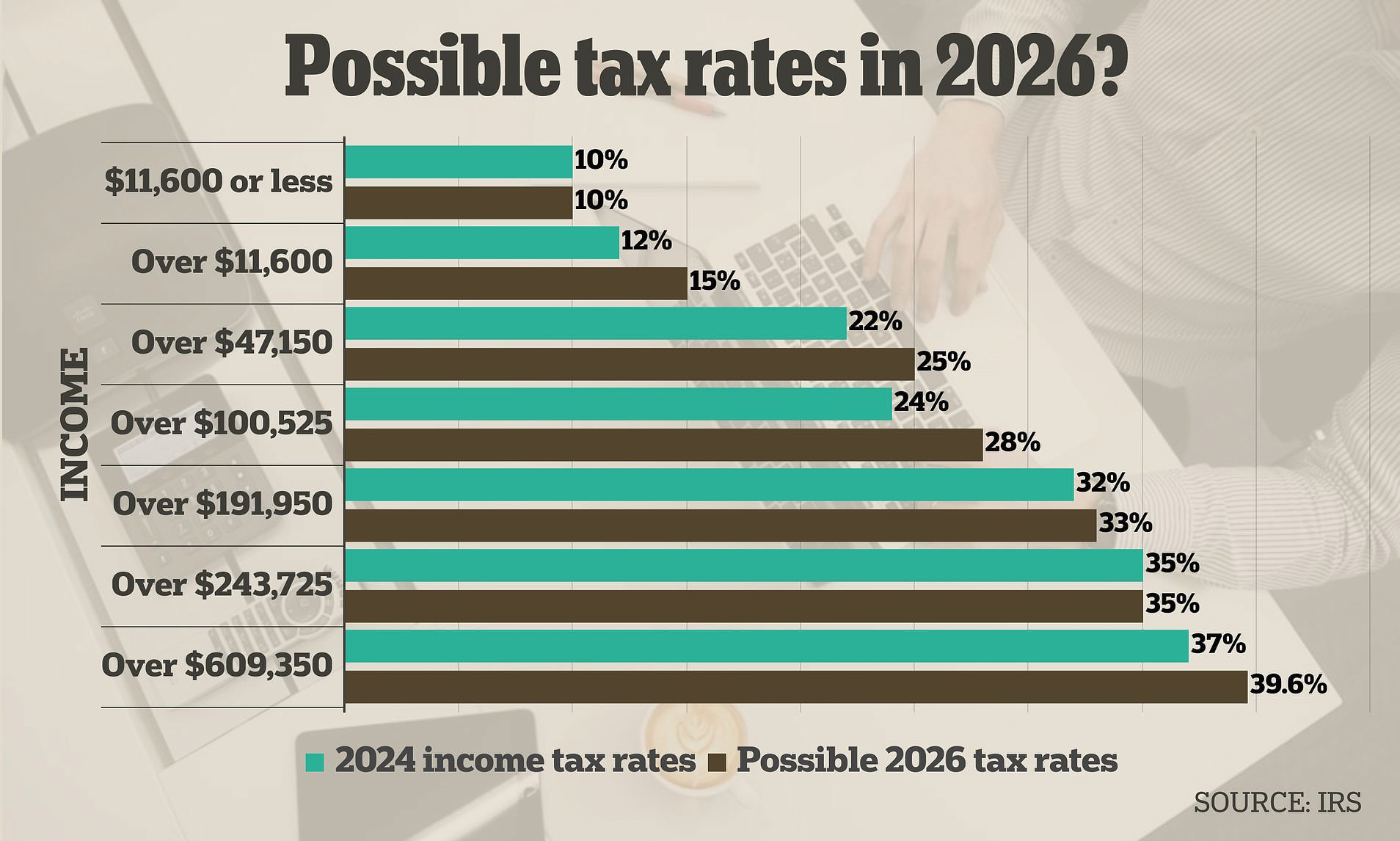

- The reason why you may have to pay MORE tax in 2026

- Tax 2026 text on wooded blocks with blurred nature background. Taxation ...

- First Glimpse at Tax Brackets in 2026 (And How Much More You’ll Have to ...

- Tax Brackets For 2024 Head Of Household And Single - Teena Genvieve

- Plan now? The estate planning 2026 question mark | MassMutual

- TCJA Expiring: Taxes Are Set to Increase in 2026

- Navigating the 2025 Tax Landscape: Changes on the Horizon for Taxpayers

- Plan now? The estate planning 2026 question mark | MassMutual

- Planning for Personal Tax Laws Changing in 2026 | Mercer Advisors

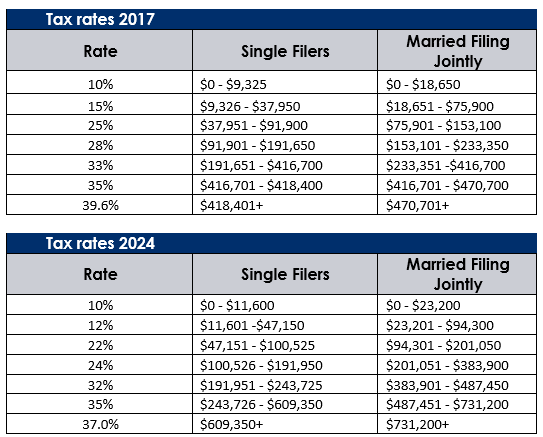

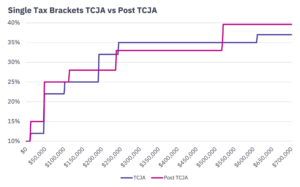

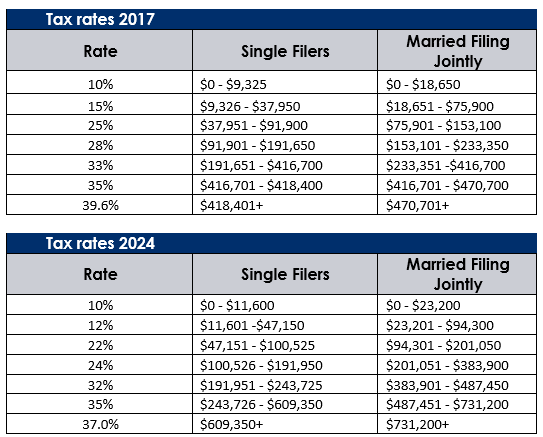

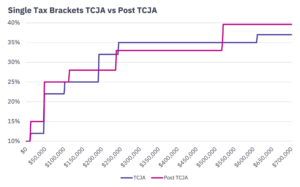

Tax Brackets and Rates for 2025

Tax Brackets and Rates for 2026

Tax Brackets and Rates for 2027

The tax brackets and rates for 2027 are expected to be: 10%: $0 to $11,400 (single) or $0 to $22,800 (joint) 12%: $11,401 to $45,700 (single) or $22,801 to $91,400 (joint) 22%: $45,701 to $97,200 (single) or $91,401 to $194,400 (joint) 24%: $97,201 to $184,900 (single) or $194,401 to $369,400 (joint) 32%: $184,901 to $235,700 (single) or $369,401 to $471,400 (joint) 35%: $235,701 to $589,300 (single) or $471,401 to $711,400 (joint) 37%: $589,301 or more (single) or $711,401 or more (joint)